Consolidating tax collection and other government payments into one modern platform can help agencies accelerate the return on investment (ROI) of technology acquisitions. Read this article to discover how.

Key takeaways include:

- Replacing legacy systems with modern tax and revenue management solutions drives the adoption of electronic payments in government.

- Agencies can leverage eBilling, payment reminders and a single check-out experience to improve service delivery and accelerate the revenue collection cycle.

- Better citizen experience leads to increased customer compliance and revenue.

Citizens want to pay property tax online

One of Forrester’s predictions for 2022 is that “80% of consumers will see the world as all digital, with no divide.” New citizen demands highlight the importance of a digital-first strategy for agencies of all sizes.

Equally important is the push toward digital equity. The U.S. infrastructure bill package, for example, included a $65 billion investment in bringing affordable high-speed internet to more Americans. The 2021 State of Cities report indicates that 24% of the communities saw improvements in the availability of broadband and digital connectivity, with this percentage reaching 34% in the case of core urban communities.

These digital trends reinforce the importance of deploying an efficient electronic government payment system, giving more convenience to residents and streamlining service delivery. As Gartner points out, more governments look at citizen experience as a key performance indicator (KPI). Offering consumer-grade services can help boost customer satisfaction and civic engagement.

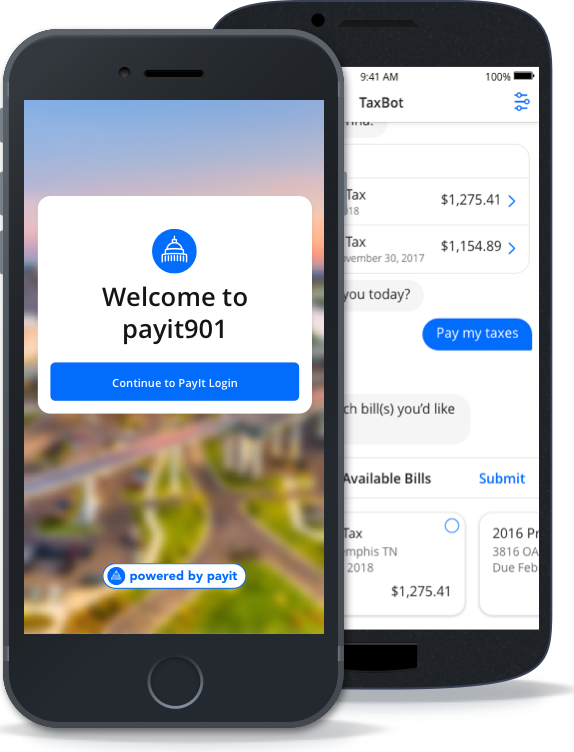

Online property tax payments bring convenience to your residents. With a government payment platform, citizens can interact with agencies anytime and anywhere. Service delivery becomes quicker when there is no need to wait for mailed bills or receipts, or visits to government buildings or banks.

Benefits of an intuitive tax software

The need to modernize IT infrastructure and service delivery to keep up with the times is the main driver for digital government transformation, according to a Deloitte study.

Improving the tax collection system is a great starting point for a scalable government platform because taxes are a leading source of revenue for municipalities. Consider, for example, MyToronto Pay. Launched in 2022, the platform currently enables the citizens of Toronto—Canada’s largest city—to pay property taxes, parking violations and utility bills online, with more services coming in the next phase of the project’s implementation.

With a modern government tax solution, agencies can:

- Increase compliance. By making it easier for citizens to pay taxes online, agencies boost their revenue collection and disburse funds faster.

- Improve employee productivity. Higher adoption of online payments and tax office workflow automation reduces manual tasks, such as payment processing and reconciliation efforts. Employees can redirect their attention to other essential projects.

- Minimize issues with legacy payment systems. Deficient legacy solutions often expose organizations to security risks and are a maintenance burden for the IT personnel.

Modern tax collection system boosts online transactions

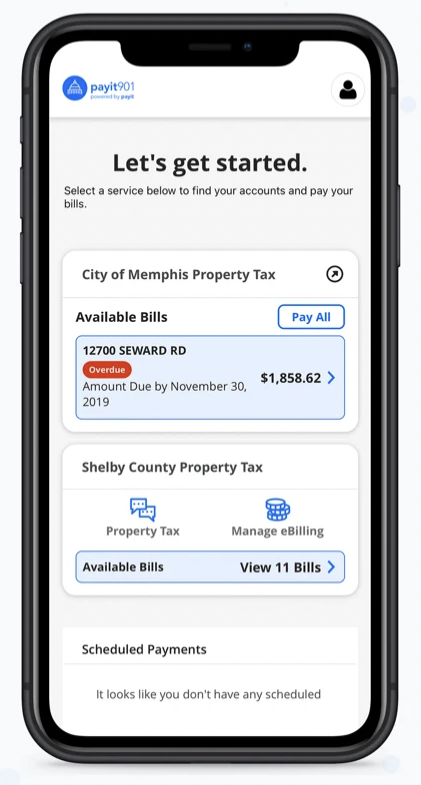

A revamped tax and revenue collection system can benefit agencies’ finances, as seen in the case of Tennessee’s Shelby County Trustee’s Office, one of PayIt’s government partners.

Despite the COVID-19 pandemic, the Shelby County Trustee’s Office registered a record year of online tax collection in 2020. Since adopting PayIt’s efficient tax solutions at the end of 2017, Shelby County has seen steady growth in year-over-year online transactions, rising from 49,900 in 2018 to 72,500 in 2020.

How government revenue management boosts electronic payments

Here are some ways that government tax software makes it easier for citizens to pay property tax online, increasing customer compliance and revenue collection:

1. Omnichannel payments

Giving citizens multiple ways to pay taxes and other government bills can help to boost compliance. The key is to provide all forms of payment, not only through digital channels such as desktop and mobile apps, but also through more traditional methods such as interactive voice response (IVR) phone payments and contactless point-of-sale (POS) terminals.

Offering a seamless and effortless user experience through multiple channels is known as an omnichannel strategy—a key trend in digital government, according to PwC.

With a government platform, agencies can offer multi-channel capabilities that empower citizens to choose how and when they want to interact with the government. It’s also important that all those channels adhere to the same workflows so that agencies can have a unified administrative dashboard for accurate reporting.

2. eBilling

Electronic billing—also known as eBilling—enables residents to go paperless and receive email notifications of their bills or statements. That means reduced mail costs for agencies, too. According to Forrester’s report on the ROI of deploying PayIt’s digital payments platform, agencies can save $11,375 over three years in mail-related expenses such as printing, envelopes and postage.

eBilling also enables a 24/7 citizen experience as residents can check their account balances and make online payments at any time.

3. Scheduled payments and reminders

Reminding citizens of their upcoming payments is another effective strategy to increase compliance. Features such as automatic payments help ensure citizens don’t miss a due date. Partial payments can also help residents manage their budgets and help governments collect funds.

ManagedPay—one of the features of PayIt’s platform—allows citizens to divide a bill’s balance into affordable automatic monthly payments. This type of feature encourages citizens to pay down delinquent balances according to their budgets.

4. Single check-out experience

Another way to simplify user experience and encourage citizen e-payment is to offer the ability to add multiple items from the same or different government workflows to a cart and then provide a single check-out experience. That’s useful, for example, when the resident has several properties. Instead of paying the taxes for each one individually, the person can pay them all in a single transaction.

5. Secure government wallet

A digital wallet enables citizens to save receipts, documents and preferred payment methods. PayIt’s government payment app is compliant with the Payment Card Industry (PCI) security standards, helping protect agencies and citizens from card fraud.

Drive the adoption of online payments with PayIt’s government revenue collection software

Agencies can deploy PayIt to digitize not only taxes but also utility bills, DMV transactions, court payments, licensing applications, tolling and more. PayIt’s software for government integrates with backend systems and is scalable to support increasing demands and new features.

Book a demo to learn more about our award-winning government revenue management solutions.