Digital wallets and the mobile payments they enable are quickly becoming the preferred way for everyday citizens to pay for services and products. These payment options are fast, secure and easy to use in a range of transactions, from shopping for clothing to making doctor co-pays to paying for government services like license renewals and trash pickups.

Digital wallets were gaining users before the pandemic began, but the need for contactless payment in stores and the shift to more online commerce have accelerated their adoption.

For example, North American mobile wallet use increased from 38% pre-pandemic to 55% by late 2020, according to industry media outlet PYMNTS. Worldwide, payments from digital wallets will account for more than 52% of eCommerce transactions by 2023, according to FIS data cited by PYMNTS.

What’s more, people aren’t only using digital wallets for in-store shopping and eCommerce; their expectations for digital wallet options in non-retail settings will almost certainly continue to increase.

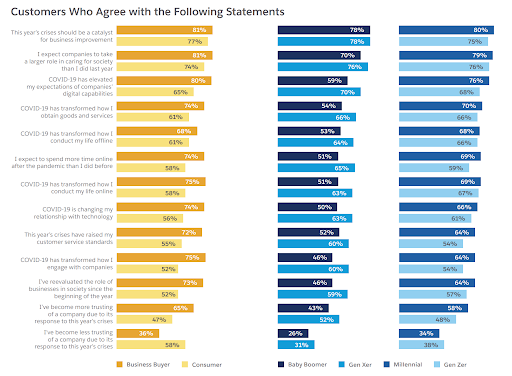

That’s because as customers discover a convenience or innovation in one area, they expect to have access to it in other areas. For example, a multinational survey of thousands of business customers in 2020 by Salesforce found that the pandemic has prompted most consumers to raise their customer service standards and their expectations of companies’ digital capabilities. In all, the survey found that 78% of customers said that 2020’s crises should spur business improvement, while 88% expect companies to accelerate digital initiatives as a result.

Image: Salesforce State of the Connected Customer, 4th. Ed.

Because constituents expect convenience and innovation, agencies that adopt mobile payment apps with digital wallets can deliver a better constituent experience, provide faster constituent support, reduce late and missed payments. In addition, operationally employees will spend less time on manual billing, payment processing, license and certificate renewals and document requests.

Local and state government apps that facilitate e-service delivery can also shorten time to revenue and reduce the number of in-office visits that employees must handle.

Learn how to create a better citizen self-service experience with PayIt.

What’s the difference between mobile wallets, digital wallets and mobile payments?

There are a lot of terms for digital and mobile payments. Some overlap but have slightly different meanings, so it’s helpful to get clear on the definitions.

A digital wallet is a secure, online place where users can store their preferred payment options, then use the wallet at checkout. For example, a digital wallet user can enter credit card, debit card and ACH information for the accounts they want to use as part of their digital wallet, where those credentials will be securely stored online.

Then, when the user shops with a merchant who accepts digital wallet payments, they can select their digital wallet, choose the payment method inside their wallet that they want to use and check out. Users don’t have to key in their card or bank account information for every purchase, and the wallet tokenizes and encrypts their payment data, so the merchant never sees their detailed card information. Digital wallets work for online purchases made on computers, tablets and smartphones.

Mobile wallets are digital wallets with an extra feature: the ability to securely transmit payment information from the user’s smartphone or smartphone-connected wearable (like an Apple Watch) to an NFC-enabled checkout terminal in a physical store—usually by tapping the phone on the point of sale system’s terminal.

Mobile payments, meanwhile, are any payments made via a mobile device, whether they’re made in an app with a digital wallet, by tapping an in-store checkout terminal or through a mobile website’s checkout process.

The best government mobile apps—the ones that are improving service delivery in government—include some form of a digital wallet to streamline a variety of constituent services and let constituents pay in the ways that work best for them.

What kinds of payments can mobile wallets handle?

We’ve already seen that mobile wallets can facilitate credit, debit and ACH payments at terminals, in apps and on the web. When these wallets are part of a government services app, they can also offer constituents a full menu of payment options, including:

- Automatic payments: Constituents who want to spend less time paying utility and trash bills, for example, can set up automatic payments using an account in their digital wallet

- Automatic account reloading/replenishing: Busy commuters don’t always have time to manually add funds to their toll tag balances. Optional automatic reloads can handle it for them when their balance reaches a value they select

- Instant (one-tap) payments: Constituents are already used to the convenience and time-savings of one-tap payments when they shop. The best mobile payment systems enable the same functionality on government mobile apps

- Managed payments: Property tax bills, big utility bills and other large bills are easier to pay—and more likely to be paid in full—if constituents can divide them into smaller automatic monthly payments

- Scheduled payments: Let your customers choose the payment date for their next utility bill, based on their trash, water or electric bill due date, so they can manage their household budgets more easily

What types of government agencies and services can accept mobile payments?

Government organizations of any size can accept mobile payments. They’re helpful for small agencies that lack the staff to process in-person, mail and telephone payments, especially during peak times like property tax season. For large agencies, mobile payments can help handle larger transaction volumes more efficiently and reduce crowding and wait times at government offices.

For example, some government agencies are already accepting mobile payments for:

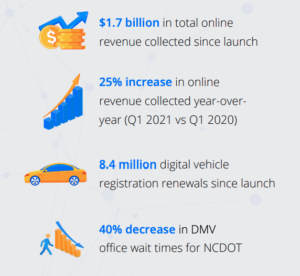

Vehicle registrations and renewals. The North Carolina Department of Transportation’s myNCDMV portal gives drivers and vehicle owners a digital option for renewing licenses and registrations, ordering specialty license plates and more.

The result has been more online revenue collection, more digital renewals, and shorter in-office wait times.

Image: myNCDMV: Reimagining the DMV experience for citizens

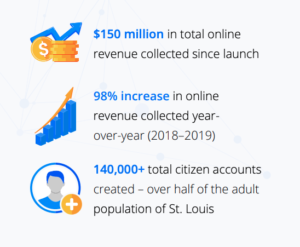

Property taxes. The City of St. Louis streamlined its payment processing system for residents and employees with payitSt.Louis, an all-in-one digital experience that residents can use to pay utility bills, property taxes, earnings taxes and citations. The result has been more online revenue collection, more efficient payment reconciliation and widespread engagement with St. Louis residents.

Image: Moving the City of St. Louis into the GovCloud

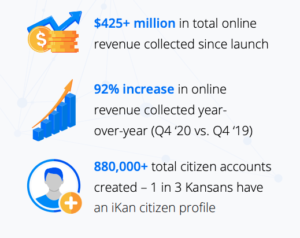

Vital records requests. In addition to license and vehicle registration renewals and property tax payments in some counties, the State of Kansas also leverages mobile payments in its iKan native app to make it easier for residents to request copies of birth, death and marriage certificates from their smartphones and pay with a digital wallet. Since iKan’s launch, online revenue collection has jumped, and one-third of Kansans have signed onto the platform.

Image: iKan: A cross-agency digital transformation

Other services that governments can accept digital payments for include:

- Water, trash and other utility bills

- Turnpike and tollway fees and tags

- Business permits, professional licenses and recreational licenses

After they complete their mobile transactions, constituents can store secure digital copies of their receipts, licenses and documents in their digital wallet for easy access.

Are mobile payments secure?

A secure payments solution is necessary for agencies seeking to digitize, both to protect their revenue streams and to protect their constituents from payment fraud. Agencies seeking to adopt mobile payments should look for providers that offer:

- AWS GovCloud infrastructure to comply with federal-level data protection and access guidelines

- PCI Level 1 payment data-protection compliance to protect users’ payment data and reduce agencies’ fraud liability

- Data tokenization and encryption to prevent interception of payment data, government documents and other sensitive information

- Continuous security monitoring and updates for optimal safety and performance

How hard is it to add mobile payments to government agency systems?

Mobile payments have the potential to drastically improve service delivery in the public sector, but there are technical challenges. A high-quality government digital service app needs to integrate data from legacy systems into an easy-to-use front end on a platform that’s secure and compliant with applicable data-protection regulations.

The solution is to work with a provider that has extensive experience in building government software and mobile apps for city governments, counties and state agencies. An experienced, customer-focused solution developer will be able to:

- Build a solution that unifies data from legacy systems in line with your agency’s business rules, goals and branding

- Build on a platform that helps your agency meet federal data protection and PCI Level 1 data security standards

- Publish continuous updates, improvements and new features to make your mobile payment system work better and do more

- Deliver the finished app in 90 days or less

- Assist your agency with app marketing and ongoing customer support

Boost agency efficiency with a modern payment system

The best mobile payment app for government organizations includes secure payment processing, secure storage of receipts and government records, a variety of payment methods and options and custom integration with existing systems of record.

See how PayIt can help you give your constituents the mobile payment experience they want, at no cost to your government agency. Request your custom PayIt demo.